Supermicro: High-Performance Computing Leader.

Super Micro Computer Inc. DBA Supermicro, is an American company established in 1993 and Headquartered in San Jose, California. They’ve carved a niche as a leading provider of high-performance, high-efficiency server technology and green computing solutions.

What Makes Supermicro Computer’s?

- Innovation and Performance: Supermicro is renowned for its High-Performance server technology, Delivering exceptional performance for data centers, cloud computing, artificial intelligence (AI), 5G/edge computing, and various enterprise needs.

- Green Computing Focus: They prioritize environmentally friendly practices, developing energy-efficient server solutions encompassed by their “green computing” approach. This focus aligns with the growing demand for sustainable IT solutions.

- Diverse Product Portfolio: Supermicro offers a comprehensive range of server solutions, including server management software, storage systems, and various server form factors like blades and racks. This caters to diverse customer requirements across various industries.

- Global Presence: With manufacturing facilities in Silicon Valley, the Netherlands, and Taiwan, Supermicro boasts a global presence, ensuring efficient production and distribution capabilities.

Supermicro’s Impact

Supermicro has garnered recognition for its achievements:

- Ranked #1 Fastest Growing IT Company Globally: By Fortune Magazine in 2018, highlighting their remarkable growth trajectory.

- Leader in High-Performance Computing: Established as a prominent high-performance computing (HPC) player, catering to demanding computational needs.

- Commitment to Sustainability: Their emphasis on green Computing solutions resonates with the growing focus on environmental responsibility within the IT sector.

Looking Ahead for Supermicro

As the tech landscape continues to evolve, Supermicro is well-positioned to maintain its leadership role. Their dedication to innovation, performance, and sustainability positions them to cater to the ever-growing demand for efficient and powerful computing solutions across various industries.

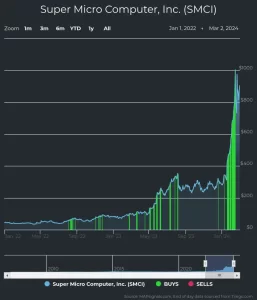

Super Micro Computer Stock Price: Soaring High!

Super Micro Computer Inc. (SMCI), a leading provider of high-performance computing, storage, and networking solutions, has seen its stock price soar in recent times. As of March 7, 2024, SMCI is trading at $1,124.70 USD, reflecting a 3.10% increase from the opening price.

This significant rise has captured the attention of investors, prompting many to search for information about SMCI’s stock performance. This article delves into the current state of Super Micro Computer’s stock price, exploring recent trends and potential factors driving its growth.

Current Performance and Key Metrics:

- Stock Price: USD 1,124.70 (as of March 7, 2024)

- Change: +3.10% (from opening price)

- 52-Week Range: $87.25 – $1,077.87

- Market Cap: $62.91 billion

Factors Potentially Influencing the Stock Price:

Several factors could be contributing to SMCI’s rising stock price:

- Increased Demand for High-Performance Computing: The growing demand for cloud computing, artificial intelligence, and big data analytics drives the need for powerful computing solutions, which benefits companies like Super Micro.

- Recent Convertible Note Offering: In February 2024, Super Micro successfully priced a $1.5 billion convertible note offering, potentially indicating investor confid the company’s prospects.

- Positive Analyst Ratings: Several analysts have issued positive ratings on SMCI stock, further boosting investor sentiment.

Looking Forward:

While the future performance of any stock is inherently uncertain, Super Micro Computer appears to be well-positioned for continued growth. The company operates in a dynamic and expanding market, and its recent strategic initiatives suggest a focus on capturing future opportunities.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It’s crucial to conduct your own research and due diligence before making any investment decisions.